In other words, fixed costs are not dependent on your business’s productivity. So, you should produce those goods that generate a high contribution margin. As a result, a high contribution margin would help you in covering the fixed costs of your business. Furthermore, an increase in the contribution margin increases the amount of profit as well. Furthermore, it also gives you an understanding of the amount of profit you can generate after covering your fixed cost. Such an analysis would help you to undertake better decisions regarding where and how to sell your products.

Contribution Margin Example

This is because it indicates the rate of profitability of your business. The gross sales revenue refers to the total amount your business realizes from the sale of goods or services. That is it does not include any deductions like sales return and allowances.

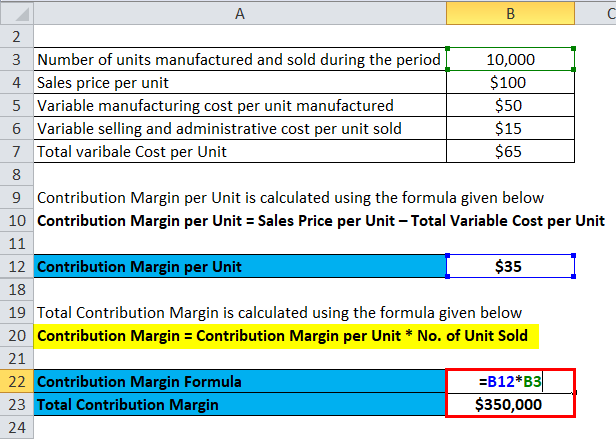

Contribution Margin Analysis Per Unit Example

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Variable Costs

Management uses the contribution margin in several different forms to production and pricing decisions within the business. This concept is especially helpful to management in calculating the breakeven point for a department or a product line. Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues. It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed. The contribution margin is a business’s sales revenue minus its variable costs.

Contribution Margin Per Unit:

The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. Let’s begin by examining contribution margin on a per unit basis. The Indirect Costs are the costs that cannot be directly linked to the production. Indirect materials and indirect labor costs that cannot be directly allocated to your products are examples of indirect costs. Furthermore, per unit variable costs remain constant for a given level of production.

- When it splits its costs into variable costs and fixed costs, your business can calculate its breakeven point in units or dollars.

- Businesses calculate their contribution margin as a total contribution margin or per-unit amount for products.

- This minimum-sale-price analysis is called a break-even analysis.

- Watch this video from Investopedia reviewing the concept of contribution margin to learn more.

Barbara has an MBA from The University of Texas and an active CPA license. When she’s not writing, Barbara likes to research public companies and play social security 2020 Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. Find out what a contribution margin is, why it is important, and how to calculate it.

Fixed costs include periodic fixed expenses for facilities rent, equipment leases, insurance, utilities, general & administrative (G&A) expenses, research & development (R&D), and depreciation of equipment. Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income. Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. Let’s now apply these behaviors to the concept of contribution margin.

Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. In accounting, contribution margin is the difference between the revenue and the variable costs of a product. It represents how much money can be generated by each unit of a product after deducting the variable costs and, as a consequence, allows for an estimation of the profitability of a product. In the United States, similar labor-saving processes have been developed, such as the ability to order groceries or fast food online and have it ready when the customer arrives. Do these labor-saving processes change the cost structure for the company? However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed costs).